AG’s Report Finds Profound Racial Housing Disparity in Albany. How Can It Be Fixed?

AG’s report finds profound racial housing disparity in Albany. How can it be fixed?

A report released by state Attorney General Letitia James this fall shows significant racial disparities in home ownership across New York. But the city of Albany’s is nearly the worst in the nation.

The report details deep racial disparities in home ownership and access to home financing across the state. Among its top findings is a stark racial gap in home ownership rates in every region in New York, with white households owning their homes at nearly double the rate of households of color. United Tenants of Albany Executive Director Canyon Ryan says the AG's finding that the city of Albany has the nation’s second-largest gap between Black and white homeowners comes as no surprise.

“Last year, Albany County had the fourth most evictions of any county in the state above the New York City boroughs," Ryan said. "So that's per renter, per populous, we will also greatly struggle with evictions. And again, that's a racial and economic issue in a majority renter cities and it's no surprise that with increasing rents, and increasing housing scarcity, which proliferates issues around rent, but also people's ability to keep up with the rent, you know, Albany has a poverty rate that's twice the national average. All of this kind of combines into a situation where low income renters have no prospect of becoming homeowners. And if anything, it's more likely that they'll face an eviction proceeding before they face, you know, a new opportunity to purchase a home. And then with interest rates climbing too, it's just it's a incredibly volatile market for low income folks to figure out how they can build equity and wealth in a city that does have a housing scarcity that's also being gobbled up by corporate landlords.”

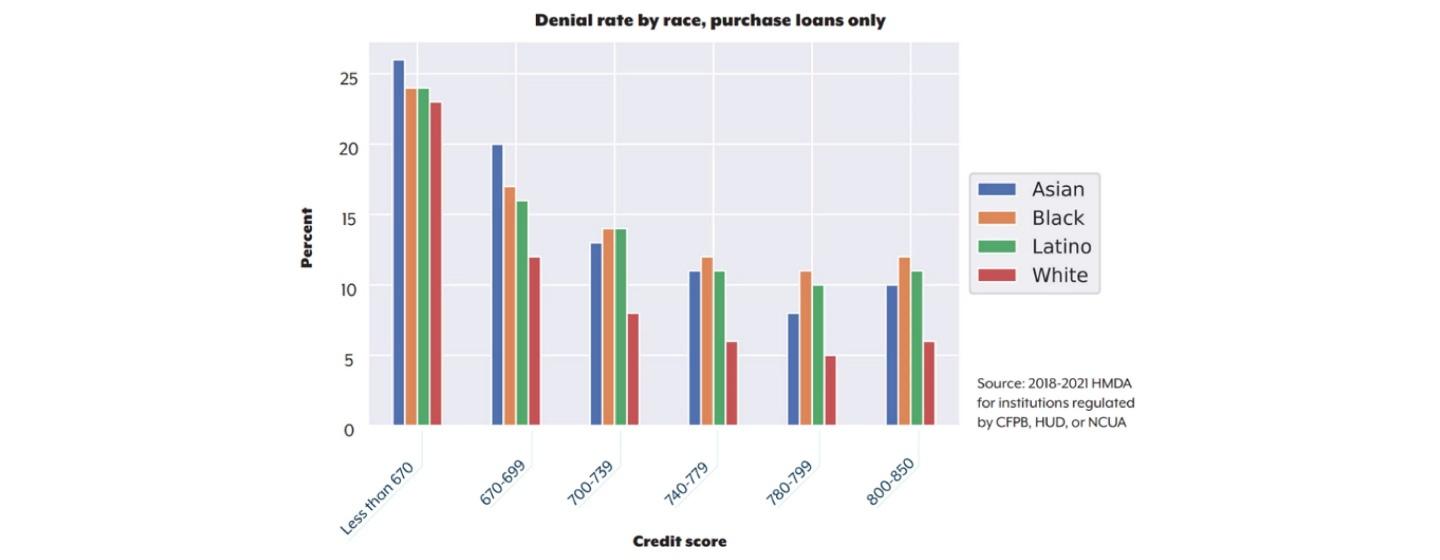

The report found people of color who applied for mortgages in 2021 were more likely to be denied than white applicants. It also found that Albany, Long Island and Rochester had fewer mortgage applications from communities of color within city limits. Albany Mayor Kathy Sheehan:

"It's not surprising what the attorney general found. The findings applied to the entire Capital Region it was and it wasn't just the city of Albany. I think the racial disparities around homeownership are even starker in some of our surrounding suburban communities. But it's why we knew when we had the opportunity with ARPA money, that we had to invest in homeownership opportunities. And so we're funding 100 new Habitat homes, those are home ownership opportunities right here in the city of Albany, and a number of other smaller projects, because we want to ensure that we're giving people the opportunity to build wealth in their neighborhoods, and put people on a path to have and enjoy homeownership. It's a critical part of people's financial stability going forward. And that's why we're putting our money where our mouth is to address this issue that we know exists, not just here, but across the country,” Sheehan said.

Albany's Chief City Auditor (and recently declared mayoral candidate) Dorcey Applys finds the AG's report discouraging. “The sad part is there's nothing new under the sun here. And I am concerned that we have become so desensitized to the blatant disparities, in particular racial disparities, when it comes to housing and economic prosperity for people of color in this city. And so when I think the report from the AG'S office, but also if you look back, there was a report by the Urban Institute, which basically the headline was that Albany is one of the worst places to live for people of color, “ said Applyrs.

Hoping to rewrite that headline is Charles Touhey, whose foundation has provided funding to help people of color buy homes in the Capital Region, in the form of a grant: $10,000, if you buy a house in Albany.

“Because Black families have been shut out of home ownership, new Black families who want to buy houses, can't go back to their family for this cash that they need to get to the closing," said Touhey. "And so our fund is a recognition of the injustice. And it's why it's called Restorative Justice Fund. The injustice for black families of not being able to have that final amount of cash that helps them over the top. And what since we've been doing the program, we've helped about 150 families in Albany, Troy and Schenectady. And so that's nice, and we're happy about it. But we're only one organization, and the Attorney General's report addresses the structural problems of the lenders themselves, not being interested in this. And for example, when the land bank, our land bank, built, inaugurated our first home-owner-built house at 360 Sheridan Avenue in Albany, and we had a press conference. And we want to sell this to someone in the neighborhood. This is a red line neighborhood, not a single bank stepped forward and said we'd like to do the mortgage on this family. So that sort of tells you how lenders are still standing on the sidelines, in terms of making a sincere effort to help Black families.”

Applyrs notes the AG's report recommends subsidizing down-payments for first-generation homeowners while investing in more community-centric banks that would ensure representatives from communities of color have better access to capital. “We need to now spring into action, implementing the recommendations that have come out in the report but also have been coming out for decades, investing the resources where they need to be endorsed so aggressively," Applyrs said. "So educating people about what it means to be a homeowner, why it's important, how we create generational wealth. If you don't know the link between home ownership and generational wealth, why would one look at or prioritize investing in homeownership? So I think we have to start at a very basic level, given the gaps that we're seeing, and really inform residents about why it's important to own your own home, before we can even get to making or simultaneously making funds available for first time home owners, because that's important, but you can't do that without the education piece.”

This story was originally published on 11/27/2023 on WAMC.

Related

Hochul Urged To Sign Bill Shifting Some Local Elections to Even Numbered Years

Will Governor Hochul sign a bill to get rid of some odd year elections in favor of holding the contests on even numbered years?